Our Blogs

Expert analysis and market trends for savvy investors

Is Long-Term Investing in India Still Worth It? My Perspective After the 2025 Market Drop

The year 2025 was a reality check for the Indian investor. After a multi-year bull run that seemed invincible

Read More

Which Sectors Are Outperforming Despite the Crash? A 2025–26 Snapshot

While the Nifty 50 managed a modest double-digit return, the broader market was a battlefield of volatility.

Read More

What 2026 Might Bring for Indian Equity: Predictions, Scenarios & What to Watch

As we stand at the threshold of 2026, the Indian equity landscape is no longer just about "emerging" potential—it is about performance and maturity.

Read More

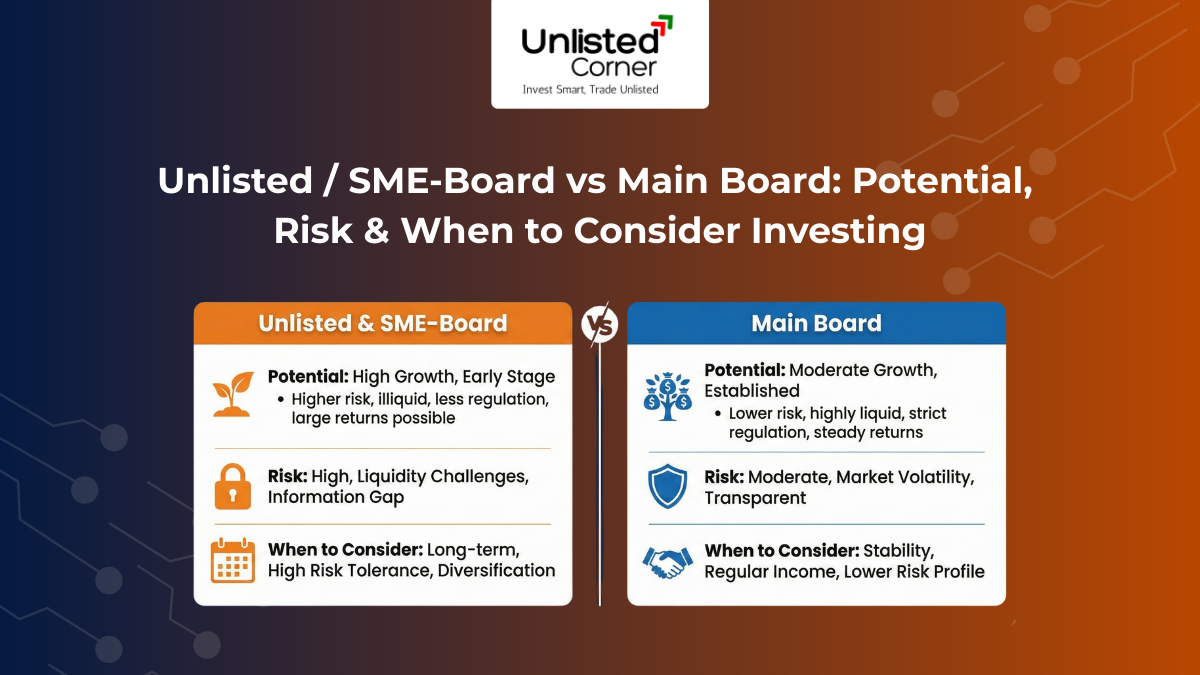

Unlisted / SME-Board vs. Main Board: Potential, Risk & When to Consider Investing

The Indian equity landscape in 2026 has evolved into a multi-tiered ecosystem. Investors are no longer limited to the household names of the Nifty 50.

Read More

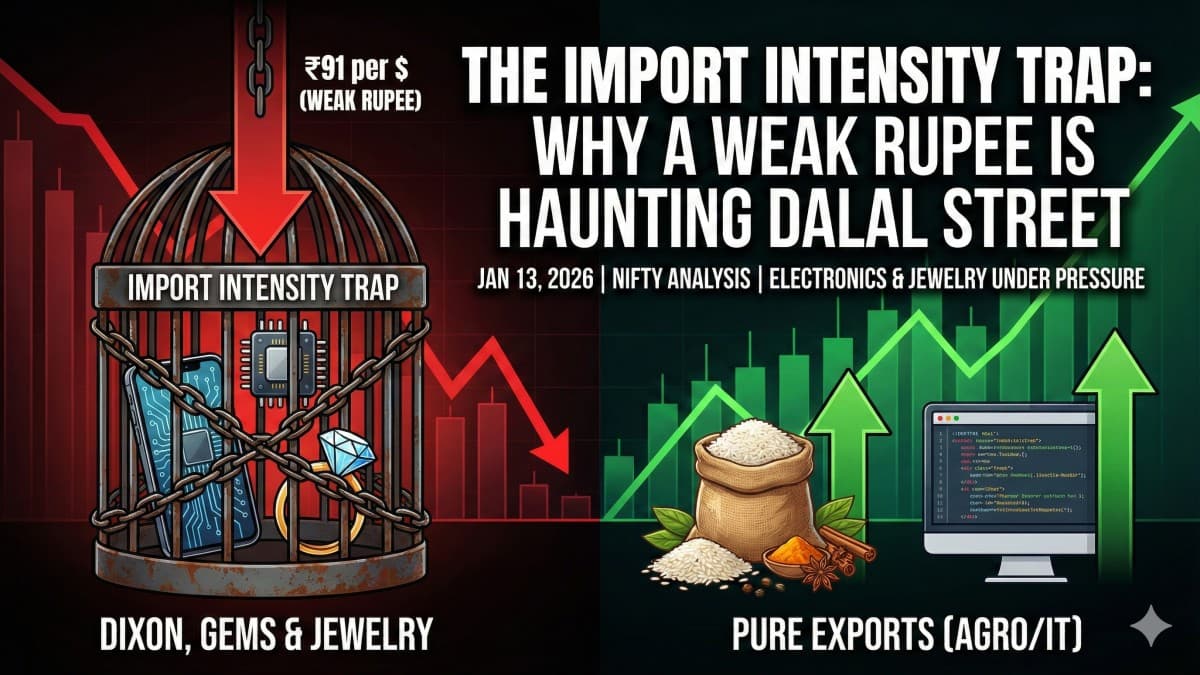

The Import Intensity Trap: Why a Weak Rupee is the New "Ghost" Haunting Dalal Street

Why the weak Rupee is a 'margin killer' for Dixon & electronics stocks. Decoding the Import Intensity Trap on Dalal Street.

Read More

Earnings vs. Extortion: Can IT Giants Save Dalal Street from the "Trump Tariff" Storm?

Nifty & Sensex slide as Trump tariffs hit sentiment. Can TCS Q3 results save Dalal Street? Read our latest market analysis & strategy

Read More

The 2026 "Tariff Tantrum": Why Global Headwinds Demand a Shift to Domestic Harbours

Navigate the 2026 Indian stock market 'Tariff Tantrum.

Read More

Unlisted / SME-Board vs. Main Board: Potential, Risk & When to Consider Investing

The Indian equity landscape in 2026 has evolved into a multi-tiered ecosystem. Investors are no longer limited to the household names of the Nifty 50.

Read More

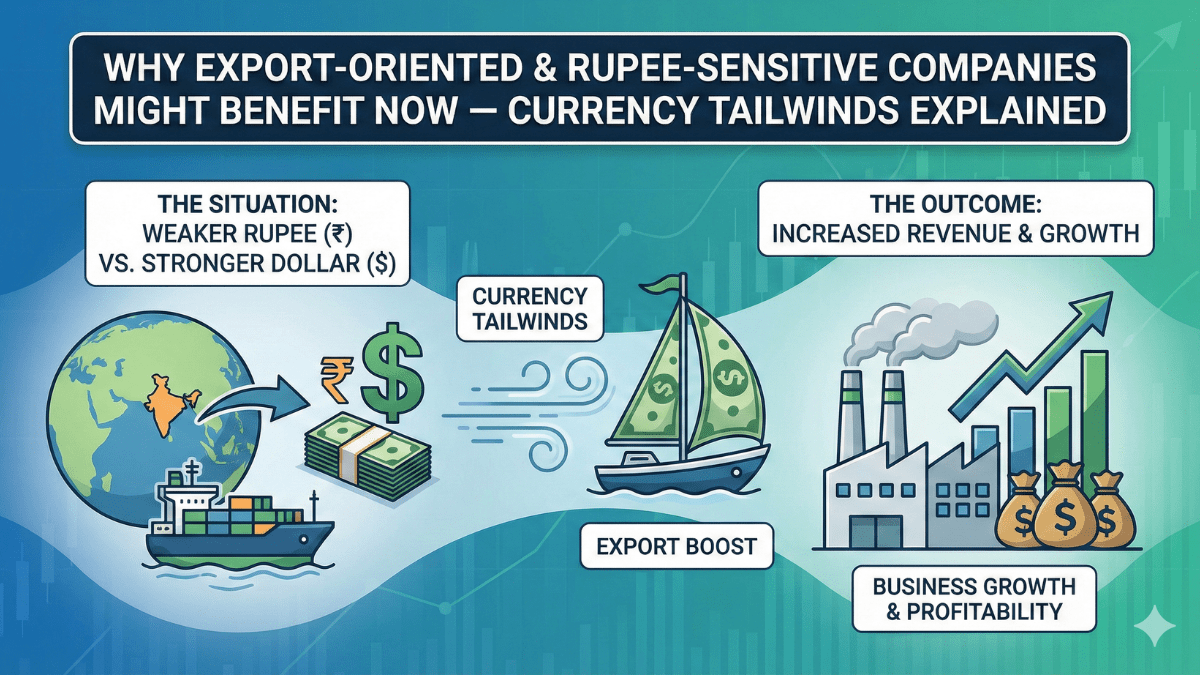

Why Export-Oriented & Rupee-Sensitive Companies Might Benefit Now — Currency Tailwinds Explained

We explore why rupee-sensitive sectors like IT, Pharma, and Chemicals are positioned to be the "dark horses" of 2026.

Read More

Are Tech & IT Stocks Still a Safe Haven in 2025–26? Prospects Amid Global Slowdown & Rupee Pressure

However, as we navigate a world where Artificial Intelligence (AI) is moving from pilot to production and the Rupee has breached the 91 per USD mark

Read More

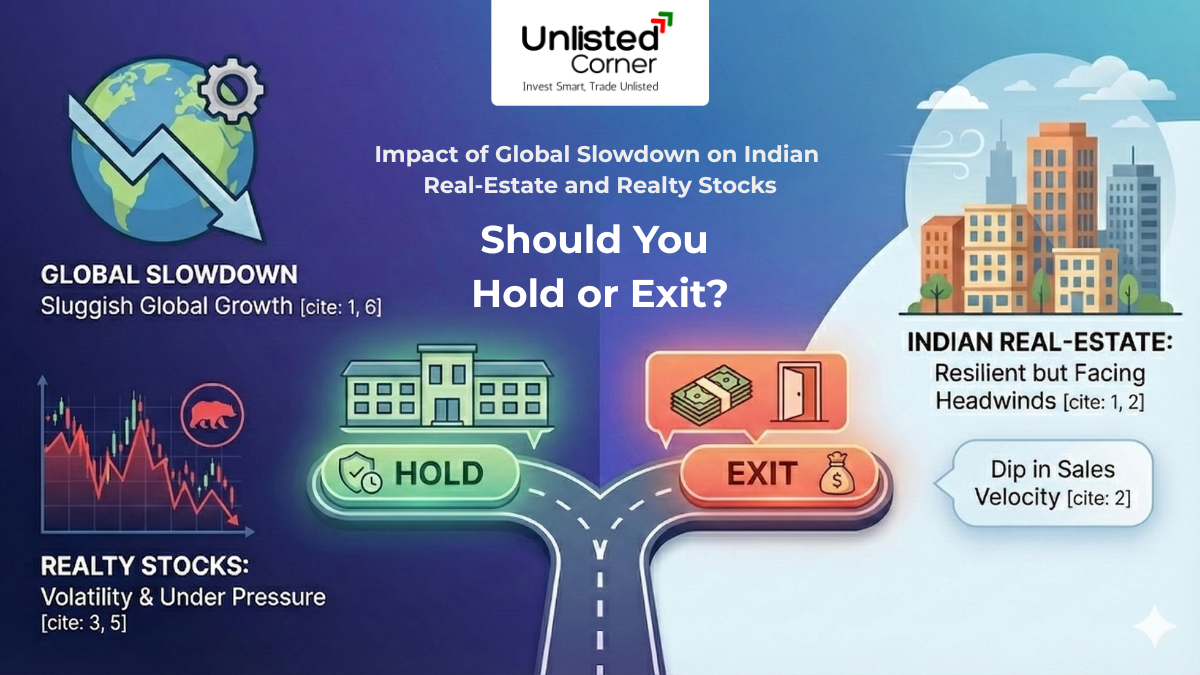

Impact of Global Slowdown on Indian Real Estate & Realty Stocks: Hold or Exit?

While global headlines are dominated by a "synchronized slowdown" across major economies like the US, Europe, and China.

Read More

Why Some Mid-Caps Crash Hard but Rebound Strong — The Anatomy of a Recovery in Indian Markets

In the high-stakes world of the Indian stock market, mid-cap stocks are often described as the "adrenaline junkies" of an investor's portfolio.

Read More

Why Diversification (Large + Mid + Small + IPOs) Matters Especially Now in Indian Markets

After a period of record-breaking highs in 2024 and significant consolidation throughout 2025, investors are now navigating a "dispersion" phase.

Read More

Post-IPO Watchlist: 5 Promising New Listings (2025–26) That Are Under-Hyped

The primary market has been dominated by "showstoppers" like Tata Capital, LG Electronics India, and ICICI Prudential AMC.

Read More

How to Find Under-Valued Mid/Small-Caps in India — Metrics, Tools & Red Flags”

In the ever-evolving landscape of the Indian stock market, 2026 stands as a year of "Valuation Discipline."

Read More

How to Evaluate PSU, Mid-Cap & Small-Cap Stocks in a Bearish Market — Checklist for 2026

The year 2026 presents a unique landscape for the Indian equity market. After a period of "narrow leadership" and consolidation in 2025

Read More

5 Mistakes New Investors Make in Volatile Markets — And How to Avoid Them

Market volatility can feel like a rollercoaster ride where the tracks are invisible and the seatbelts feel loose.

Read More

Foreign Capital Flight & Indian Markets: Lessons from Recent Outflows — How To Position Your Portfolio

The phrase "Foreign Institutional Investor (FII) Outflow" has dominated Indian financial news cycles throughout late 2024 and much of 2025.

Read More

How Global Events & US Fed Decisions Are Impacting Indian Markets — What Indian Investors Should Know

Understand how US Fed rate cuts, the weakening Rupee, and global trade shifts impact Nifty and Sensex in 2025. Expert analysis on FII flows, inflation

Read More

Is 2025 a Buying Opportunity? Mid-Cap & Small-Cap Stocks Under Pressure — What to Watch For

Mid-Cap and Small-Cap indices have faced significant pressure in 2025, marking a major correction after years of stellar returns.

Read More