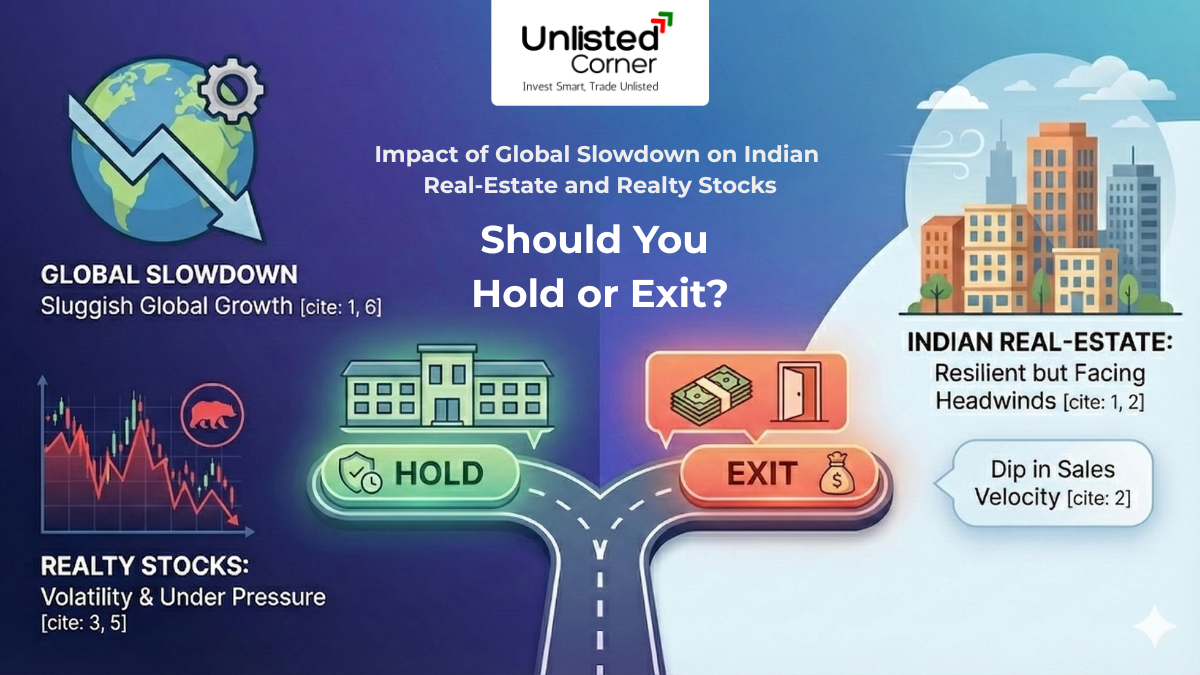

As we step into 2026, the Indian real estate sector finds itself at a fascinating crossroads. While global headlines are dominated by a "synchronized slowdown" across major economies like the US, Europe, and China, the Indian "Realty" story is unfolding with a defiant, albeit disciplined, resilience.

For the retail investor, the dilemma is real: The Nifty Realty Index declined by 16% in 2025, yet developers like DLF, Godrej Properties, and Prestige Group are reporting record-breaking pre-sales. Is the current dip a "Value Trap" triggered by global headwinds, or is it a "Golden Entry Point" before the next upcycle?

This comprehensive guide dissects the impact of the global slowdown on Indian real estate and provides a clear 2026 roadmap for your portfolio.

🏗️ 1. The Global vs. Local Tug-of-War

To understand the 2026 outlook, we must look at the two opposing forces acting on the Indian property market.

The Global Headwinds (The "Slowdown" Factor)

- FII Exodus: In 2025, India witnessed record Foreign Portfolio Investor (FPI) outflows of nearly $18 billion. High global interest rates and "AI-mania" in the US diverted capital away from emerging market real estate.

- Trade Disruptions: Global trade friction and currency volatility (with the Rupee hovering near 90 per USD) have increased the cost of imported raw materials for luxury projects.

- GCC Sentiments: While Global Capability Centres (GCCs) continue to lease office space in India, any severe global recession could temporarily slow down their expansion plans in cities like Bengaluru and Hyderabad.

The Domestic Tailwinds (The "Resilience" Factor)

- The Rate Cut Catalyst: Following a challenging 2025, the Reserve Bank of India (RBI) slashed the repo rate by 125 basis points in late 2025. In 2026, this is finally translating into lower home loan rates, boosting affordability.

- Consolidation of Power: The market has shifted toward branded developers. The "unorganized" players are vanishing, leaving high-quality, listed companies to capture the lion's share of demand.

- Inventory Discipline: Unlike the 2008 crash, current unsold inventory in top metros is at a healthy 1.7x of annual sales, far below the "danger zone" of 2.5x.

🏢 2. Sectoral Deep Dive: Where is the Growth?

Not all real estate is created equal in 2026. The impact of the slowdown varies across segments:

A. Residential: The Premiumization Play

The "Post-COVID frenzy" has cooled, but the Luxury (₹1.5Cr – ₹3Cr+) and Ultra-Luxury segments remain robust. High-net-worth individuals (HNIs) and NRIs are viewing luxury homes as a hedge against inflation.

- The Shift: Developers are moving away from "Affordable Housing" (sub-₹40 Lakh) due to low margins, focusing instead on integrated townships and lifestyle-centric 3BHKs.

B. Commercial: The GCC Outperformance

India has successfully transitioned from a "Back Office" to a "Global Innovation Hub."

- Office Leasing: Office absorption is projected to remain strong in 2026, driven by GCCs in BFSI, Tech, and Engineering. Prime office vacancies are expected to decline, leading to rental appreciation in Grade-A assets.

C. Logistics & Warehousing: The Dark Horse

Fueled by the "Make in India" push and e-commerce growth, the logistics sector is forecast to see a 15-18% increase in leasing in 2026. This segment is arguably the most immune to global retail slowdowns.

💹 3. Nifty Realty Index: Anatomy of the 16% Decline

Why did realty stocks crash in 2025 while the Nifty 50 rose 9%?

- Valuation Fatigue: Between 2022 and 2024, many realty stocks doubled. The 2025 crash was a "healthy correction" where valuations finally aligned with fundamental earnings.

- Earnings Lag: Real estate has a long "Revenue Recognition" cycle. The high sales of 2024 will only start reflecting in Profit & Loss (P&L) statements in late 2026 and 2027.

- Profit Booking: Institutional investors shifted capital from "High-P/E" realty stocks to "Defensive" sectors like IT and FMCG during the global volatility of late 2025.

⚖️ 4. The Verdict: Should You Hold or Exit?

✅ The Case to HOLD (Strategic Long-Term)

If you are holding Top-Tier Branded Developers (DLF, Godrej, Prestige, Lodha, Brigade), the 2026 outlook is Strongly Positive.

- Reason: The interest rate cycle has turned. Easing home loan rates usually lead to a massive volume recovery in the 6-12 months following a rate cut.

- REITs: For those seeking stability, REITs (Real Estate Investment Trusts) like Embassy or Mindspace offer attractive yields (6-8%) and professional management with lower volatility.

⚠️ The Case to EXIT (Tactical Short-Term)

- Unbranded/Tier-2 Developers: Exit stocks of developers with high debt-to-equity ratios (>0.8) or those with significant project delays.

- Overvalued Pockets: If a stock is trading at more than 3x its Price-to-Book (P/B) value without a massive launch pipeline, it’s better to book profits and wait for a correction.

❓ Frequently Asked Questions (FAQ)

Q1: Will property prices fall in 2026 due to the global slowdown? A: Unlikely. While sales volume might stabilize, property prices are expected to rise by 4-8% in 2026 due to high construction costs and limited ready-to-move-in supply.

Q2: Are Real Estate Stocks better than buying physical property? A: In 2026, stocks offer Liquidity and Transparency. Physical property offers Tax Benefits (Section 54) and Leverage. For most retail investors, REITs and listed stocks are more efficient.

Q3: Which cities are expected to perform best in 2026? A: Gurgaon, Noida, Bengaluru, and Hyderabad are the top performers due to their link with GCCs, manufacturing corridors, and infrastructure upgrades like the Dwarka Expressway.

Q4: How do RBI rate cuts help real estate stocks? A: Rate cuts lower the cost of borrowing for developers (improving their margins) and lower EMI costs for buyers (increasing demand).

Q5: What is a GCC, and why does it matter for real estate? A: Global Capability Centres (GCCs) are offshore units of MNCs. They are the primary drivers of Grade-A office demand in India.

Q6: Should I invest in Small-Cap realty stocks? A: Exercise caution. Small-cap realty is prone to extreme volatility and governance issues. Stick to the "Top 10" listed players for safety in 2026.

Q7: Is the "Affordable Housing" segment dead? A: Not dead, but under pressure. High land costs have made it difficult for developers to launch sub-₹40 Lakh homes. Look for a fresh policy push in the upcoming Union Budget.

Q8: Can global inflation hurt Indian real estate? A: Yes, through "Imported Inflation." Higher prices for steel, cement, and fuel can lead to "Cost-Push" price hikes in real estate.

Disclaimer Investment in the securities market and real estate is subject to market risks. The analysis provided is based on 2025-26 market data and expert projections. Past performance of the Nifty Realty index is not indicative of future results. Always consult a SEBI-registered financial advisor before making significant financial decisions.