The Indian equity landscape in 2026 has evolved into a multi-tiered ecosystem. Investors are no longer limited to the household names of the Nifty 50. Instead, they are increasingly venturing into the "Challenger Series" of SME IPOs and the "Early Bird" world of Unlisted Shares.

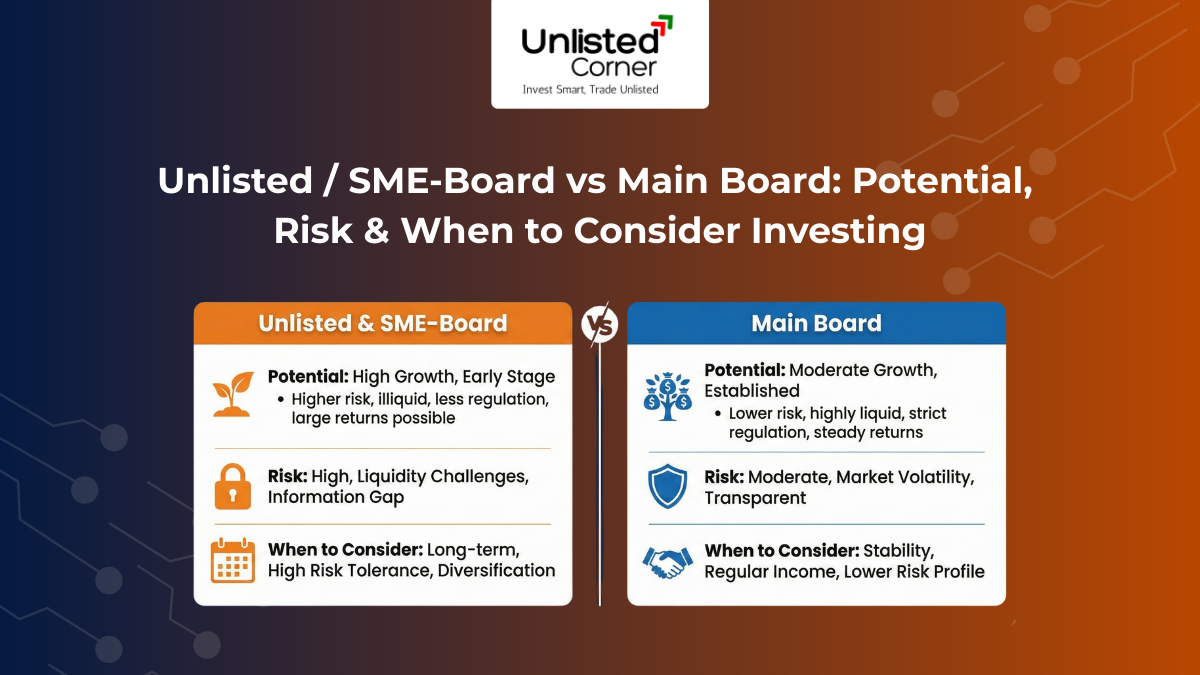

However, with greater potential comes significantly higher stakes. While a Main Board listing offers the comfort of a "Blue Chip" label, the SME and Unlisted markets are where the next "multi-baggers" are born—if you know how to navigate the risks.

🏗️ 1. Defining the Three Tiers: A Bird's Eye View

To invest wisely, you must first understand the structural hierarchy of the Indian market.

|

Feature |

Unlisted (Pre-IPO) |

SME Board (NSE Emerge / BSE SME) |

Main Board (NSE / BSE) |

|

Regulation |

Private / Less Regulated |

Moderate Exchange Scrutiny |

Strict SEBI Oversight |

|

Company Size |

Early/Growth Stage |

Small/Medium (<₹25 Cr Capital) |

Large (>₹10 Cr Capital) |

|

Liquidity |

Very Low (OTC) |

Moderate (Lot-based) |

Very High (Daily T+1) |

|

Minimum Ticket |

Varies (often high) |

₹1 Lakh to ₹2 Lakh |

₹14,000 to ₹15,000 |

|

Transparency |

Low (Private Audit) |

Moderate (Half-yearly) |

High (Quarterly) |

🚀 2. Unlisted Shares: The "Early Bird" Advantage

Unlisted shares represent equity in companies that have not yet gone public. Think of it as buying into NSE, Oyo, or Chennai Super Kings before they ever hit the stock exchange.

The Potential:

- Valuation Arbitrage: You buy at a price before the "IPO Hype" kicks in. If the company lists successfully, your returns can be exponential.

- Exclusive Sectors: Some high-growth sectors, like sports franchises or stock exchanges, are currently only accessible via the unlisted market.

The Risks:

- Liquidity Trap: There is no stock exchange. You must find a buyer through a broker. If the IPO gets delayed, your capital could be locked for years.

- Information Asymmetry: You don't get quarterly reports. You rely on private disclosures and "Grey Market" whispers.

🛩️ 3. SME Board: The High-Growth Sprint

The SME (Small and Medium Enterprise) platform is designed for young, agile companies. In 2025, the SME segment delivered staggering returns, but with a warning.

The Potential:

- Migration Potential: The ultimate goal is for an SME to grow and "migrate" to the Main Board. When this happens, institutional money pours in, often causing a massive price re-rating.

- Niche Dominance: SMEs often dominate specific, narrow industries (like specialized AI or EV components) that large caps ignore.

The Risks:

- Lot-Size Limitation: Unlike the Main Board, you cannot sell just 1 share. You must trade in lots (e.g., 1,000 shares). If the lot value is ₹2 Lakh and there are no buyers, you cannot exit partially.

- Volatile Price Bands: SME stocks can move in massive 5% or 20% circuits very quickly, leading to extreme portfolio swings.

🏟️ 4. Main Board: The "Safe Haven" Marathon

This is where the giants like TCS, Reliance, and HDFC Bank reside.

The Potential:

- Stability: These companies have deep pockets, proven business models, and high transparency.

- Dividend Yields: Main Board companies are more likely to share profits with shareholders via steady dividends.

The Risks:

- Moderate Returns: You are unlikely to see 10x returns in a single year. These are "steady compounders," not "overnight rockets."

- Systemic Risk: Main Board stocks are highly sensitive to global news, interest rate hikes, and FII sell-offs.

📊 5. When Should You Consider Each?

Choosing where to put your money depends on your Risk Appetite and Investment Horizon.

- Consider Unlisted If: You have a 3-5 year horizon and surplus capital that you don't need for emergencies. You are looking for "Hidden Gems" and have a high tolerance for opacity.

- Consider SME Board If: You are a semi-professional investor with a minimum of ₹2-3 Lakh per trade. You can perform deep due diligence on promoters and understand sectoral cycles.

- Consider Main Board If: You want to build long-term wealth with 12-15% CAGR. You value liquidity (the ability to sell any day) and want the protection of SEBI's strict reporting rules.

❓ Frequently Asked Questions (FAQ)

Q1: Can retail investors buy unlisted shares?

A: Yes, through specialized unlisted brokers and platforms. However, the risk of fraud is higher, so always verify the ISIN in your Demat account.

Q2: Why is the minimum investment in SME IPOs so high (₹1 Lakh+)?

A: Effective July 2025, SEBI increased the lot size to ensure only serious, "informed" investors participate, protecting small retail investors from extreme volatility.

Q3: Is a "Grey Market Premium" (GMP) a guarantee of profit?

A: No. GMP is unofficial and can change overnight. Never base your entire investment decision on GMP alone.

Q4: How does a company move from SME to Main Board?

A: Once a company’s post-issue paid-up capital exceeds ₹10 Crore and they meet specific profitability and net-worth criteria, they can apply for migration.

Q5: What is the "Lock-in Period" for Unlisted shares?

A: Generally, after a company goes public, pre-IPO (unlisted) shares are locked for 6 months or 1 year, meaning you cannot sell them immediately upon listing.

Q6: What is "Market Making" in SME stocks?

A: Because SME stocks have low liquidity, a broker (Market Maker) is appointed to always provide a "Buy" and "Sell" quote, ensuring you aren't completely stranded.

Q7: Are Main Board IPOs always safer than SMEs?

A: Generally, yes, due to higher SEBI scrutiny and institutional participation. However, a fundamentally weak large-cap can still lose value (e.g., some 2021-era tech IPOs).

Q8: Can I sell SME stocks in the middle of the day?

A: Yes, but only in full lots. You cannot sell "half a lot." If the stock hits a "Lower Circuit," you may not find a buyer until the circuit opens.

Disclaimer

Investment in unlisted shares, SME IPOs, and Main Board stocks involves a high degree of market risk. SME and Unlisted markets are particularly susceptible to illiquidity and information gaps. This blog is for educational purposes and is not a direct investment recommendation. Always consult with a SEBI-registered financial advisor before allocating capital.